”Survey says” looks at various rankings and scorecards judging geographic locations while noting these grades are best seen as a mix of artful interpretation and data.

Buzz: Californians are increasingly worried about the economy, with their collective optimism falling to nearly a two-year low.

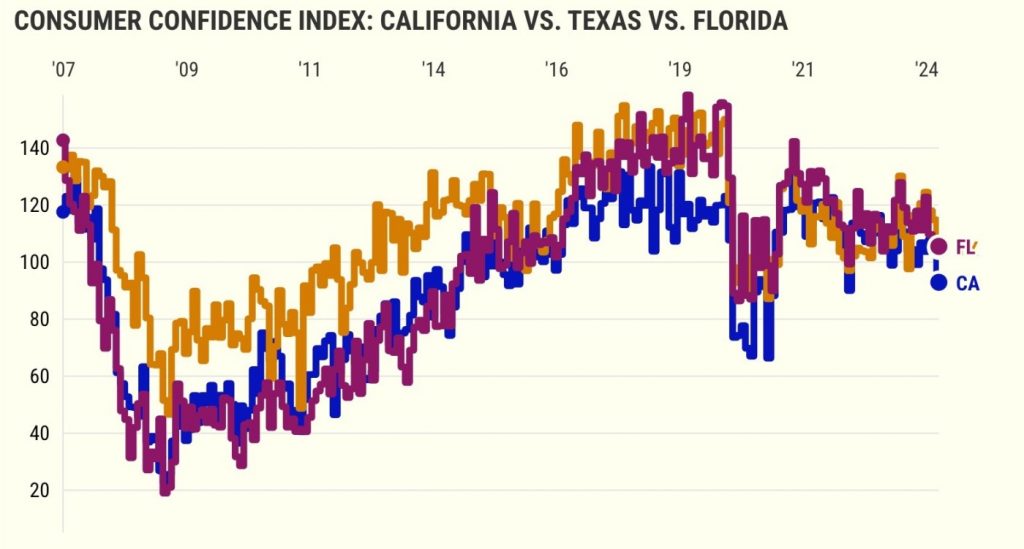

Source: My trusty spreadsheet analyzed the Conference Board’s monthly consumer confidence indexes for the state, which are based on regular polling of shoppers. We also peeked at the national results and optimism scores for two California economic rivals: Texas and Florida.

Topline

California’s confidence index for April was down 11% in a month and off 17% in a year. April had the lowest level of optimism since July 2022. That was a period of great uncertainty about the prospects for a decent economic recovery from pandemic business shutdowns.

Yet, ponder a little perspective: This is also a “typical” level of optimism. April’s score is 3% above the average reading for an index that dates to the boom days of 2007, just before the big bust and Great Recession.

Details

Inflation remains an economic headache. Unemployment, while historically low, is creeping higher. Did I mention elevated political tensions – nationally and globally?

Consider that this confidence index comprises two measures of shopper thinking – views on the “present situation” and “expectations.”

California’s view of current conditions is lofty but weakening. April’s score was off 10% in a month and 15% in a year. This decline puts this benchmark of today’s economy at its lowest since November 2023. Please note that April’s measurement is 26% above the 17-year average.

Relatively speaking, Golden State shoppers are antsy about the future.

April’s expectations were off 12% in a month and 19% in a year to the worst reading since December 2020. Yes, over three years ago. And equally worrisome: April is 15% below average.

Caveat

This monetary malaise is by no means a California thing. Ponder the confidence indexes nationally …

Overall: April was lowest since July 2022, but 6% above average.

Current: Lowest since October 2023, but 39% above average.

Future: Lowest since July 2022, and 20% below average.

In Texas …

Overall: April was lowest since September 2023, and 5% below average.

Current: Lowest since November 2023, but 13% above average.

Future: Lowest since September 2022, and 21% below average.

And in Florida …

Overall: April was lowest since March 2023, but 12% above average.

Current: Lowest since April 2021, but 43% above average.

Future: Lowest since December 2022, and 11% below average.

Bottom line

No, it’s not just YOU! Most consumers think these are relatively good times, at least in the broad sense. But that faith is softening.

Also, there’s a big “but” because shoppers, statewide and nationally, are very worried about the future.

That kind of unease about what’s next for household finances could have major consequences – economically, socially and politically.

Nervous consumers may cool their buying, not be as forgiving to neighbors – and might vote for change.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

California concerns

Is California still the world’s 5th largest economy?

California is No. 1 in U.S. for unemployment

California ranked 20 ways: from housing to crypto to wellness

Californians face 76% more cities with million-dollar home prices

Why California owners aren’t selling? Maybe they like their homes!

Related Articles

San Jose airport passenger rebound shows signs of losing altitude

More Bay Area Rite Aids closing, including one in San Jose

Fast-growing fintech Acrisure launches San Jose office at Santana Row

SunPower details Bay Area job cuts, will slash more than 100 jobs in region

Austin’s Texas glow Is fading as home prices drop, office vacancies rise