I could tell you that California paychecks kept pace with inflation – but that would be missing the bigger picture.

My trusty spreadsheet looked at federal employment data that’s a personal favorite: a quarterly report derived from unemployment insurance records. Year-end 2023 was compared with 2019 – that’s just before coronavirus upended the economy – to find inflation’s winners and losers as far as wages are concerned.

Let’s start with the ugly fact that inflation nationwide rose 19.5% in these four years, according to the Consumer Price Index. Of course, we could debate forever this benchmark’s merits. Yet even by this math, we suffered the worst four-year bout of inflation since 1991. That’s a third of a century ago.

On the other side of the ledger, average California wages rose 20.9% in those four years. Technically, that’s a “win” over inflation.

But.

Wages in 40 other states also bested the problematic bump in the cost of living. California raises were only the 31st best raise among the states, and its hikes trailed the 21.2% increase nationally.

By the way, the biggest raises were found in Montana at 28.3%, New Hampshire at 28%, Florida at 27.3%, Washington at 27.2%, and Maine at 26.7%. And we’ll note Texas pay was up only 20.2%

Plus, averages represent somewhere near the middle-of-the-pack. So, there’s a harsh reality: It’s a toss-up if your California paycheck beat inflation.

Let’s look for clues as to which paychecks were trailing the surging cost of living.

What do you do?

When looking at California employment sliced by major industries, the smaller raises seem to be concentrated in two areas.

One is white-collar office work. These are roles where employees may have been happy just to be working remotely. The second is real estate. Property-related business has cooled, in part, do to higher interest rates used by the Federal reserve to temper inflation.

The 11 industries that were inflation’s losers had 52% of California workers – and they did collectively enjoy 4.3% job growth in 2019-23. These workers are well-paid, too: $94,000 a year on average – but that wage grew only 16% in four years.

This group includes health/social care (wages up 19% in four years), professional services (18%), agriculture (18%), government (17%), construction (17%), private education (16%), management (15%), mining (14%), real estate (13%), utilities (7%), and arts/entertainment/recreation (2%).

California’s larger-than-inflation wage gains were primarily found in lower-paid work where bosses struggled to fill positions – and, thus, had to pay up to attract and keep staff.

These nine inflation-beating industries had 48% of California workers as staffing fell 1.5% in 2019-23. Their combined annualized averaged $89,000 – up 26% in four years.

Business support was No. 1, up 30% in four years, followed by manufacturing (29%), information (28%), transport/warehousing (26%), wholesale trade (25%), personal services (25%), hospitality (24%), retail (23%), and finance (22%).

Where do you work?

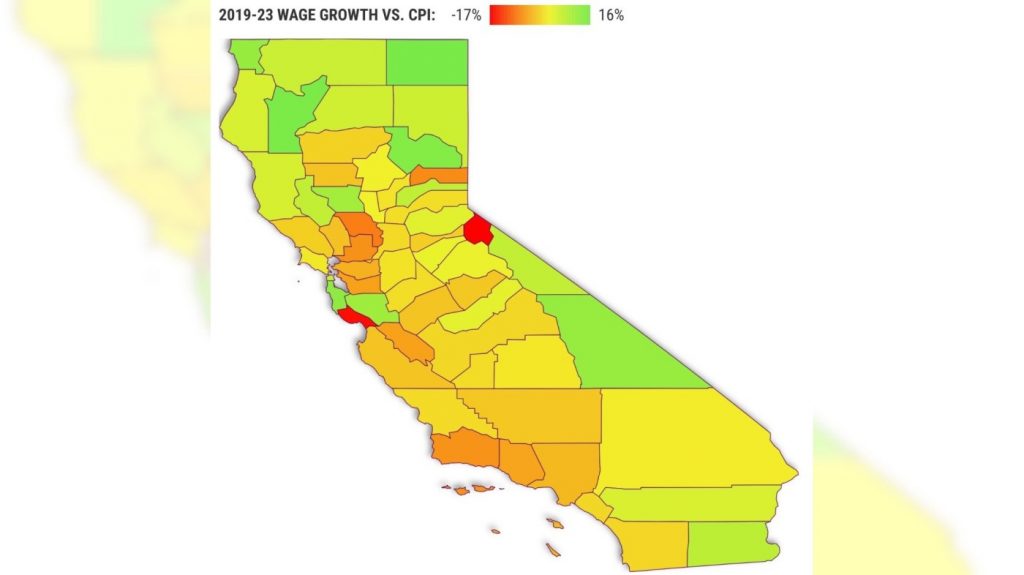

Now eyeball wages at the county level.

The 20 counties that were inflation losers – representing 43% of California workers – collectively lost 0.6% of their jobs in four years. Those trims help explain the pay weakness. Wages were up 16% to $82,800 a year.

This group was highlighted by two of the state’s largest job markets – Los Angeles County, where wages grew by only 17% in four years. and Alameda, up 15%. The other Top 10 counties in terms of employment had above-inflation raises.

Collectively, the 38 inflation-topping counties had 57% of California workers. Jobs grew by 1.5% in 2019-23 with 23% pay gains to $96,400.

The eight largest counties in this group were San Mateo (wages up 33%) Santa Clara (31%) San Francisco (27%) Riverside (25%) San Bernardino (22%) Sacramento (20%) Orange (20%) and San Diego (20%).

Bottom line

Let’s talk simple dollars and cents about the swing in California’s wages.

My pay yardstick shows a year’s wages for the typical California job leaped to $91,468 in 2023’s fourth quarter from $75,660 at year-end 2019. That’s an eye-catching $15,808 jump – and well-above the $12,898 pay bump seen across the nation.

Hey, workers in only three places fared better: Washington, D.C. (wages up $20,488), Washington state ($19,344), and New Hampshire ($17,368).

Now factor in that nasty 19.5% surge in the cost-of-living. The after-inflation California raise amounts to just $1,054 over four years. Yes, 93% less.

That slim increase in buying power ranked only a middling No. 26 among the states. It was only a few bucks more than the $976 increase nationally.

California paychecks barely breaking even is a huge pain in the wallet for folks living in a place where household finances are seriously stretched.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Related Articles

Inflation is easing. Why is car insurance still so expensive?

These Bay Area cities are now so expensive they’re considered ‘impossibly unaffordable’

California has No. 1 US wage gap between haves and have-nots

California’s top wages only buy 61% of typical home

In-N-Out Burger says it raised prices because of minimum wage increase