”Survey says” looks at various rankings and scorecards judging geographic locations while noting these grades are best seen as a mix of artful interpretation and data.

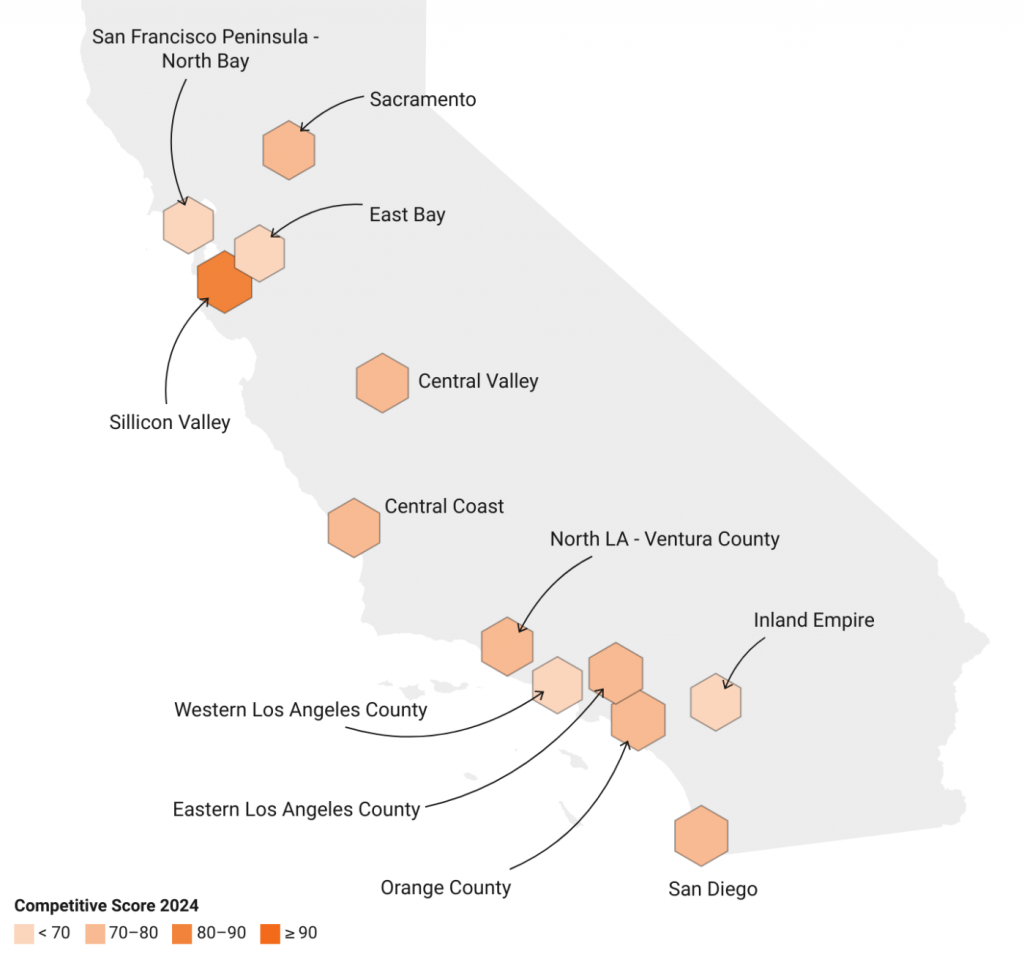

Buzz: Silicon Valley ranks as the hardest spot to find an apartment in California, with western Los Angeles County scoring as the easiest.

Source: My trusty spreadsheet reviewed the California slice of RentCafe’s mid-year study of apartment markets nationwide. The analysis revealed the most competitive places to find a rental at larger complexes. The report included 12 Golden State markets.

Topline

Related Articles

Big Fremont apartment complex lands buyer in $100 million-plus deal

Rental security deposits in California cut substantially under new law

A California woman fought remodel evictions for years. Now she’s the one being evicted

With rents on the decline, he looked for a new place. What could he find for $2,000?

San Jose food bank preps warehouse shutdown after facing rent hike

Nationally speaking, four of the 12 California markets had above-average competitiveness grades.

Silicon Valley was the sixth-toughest place to find an apartment nationally. Orange County was No. 8, eastern Los Angeles County was No. 9, and San Diego County was No. 16.

But let’s look inside the numbers that create these grades to learn what a California apartment hunter might see when seeking a new place. Consider the average metrics of the state’s six tightest markets and how they contrast with six more renter-friendly regions.

Empty units: This availability marker shows 4.4% units were vacant in the six most competitive markets. Vacancies were 6.3% in the six least competitive.

Vacancy length: How quickly must tenants act? Units go unrented for 44 days in most competitive markets – 47 days for least competitive.

How many looks: Who will you fight off? 11 prospective tenants per unit in the most competitive markets – 10 for least competitive.

Renewal rate: A popularity measure shows 54% of tenants stay in their unit in most competitive markets – 51% for least competitive.

New choices: 2.2 new units have entered the market per 1,000 old apartments in the most competitive places – 4.6 for least competitive.

Details

Here are the 12 California rental markets, ranked on RentCafe’s competitiveness scale – from hard-to-rent to easier – and those variables behind the gradings …

No. 1 Silicon Valley: 5% vacant, 40 days vacant, 12 looks, and no new units. It was California’s third-toughest market in RealCafe’s early 2024 rankings.

No. 2 Orange County: 4% vacant, 44 days vacant, 12 looks, and 3.8 per 1,000 existing rentals. No. 1 in early 2024.

No. 3 Eastern Los Angeles County: 4% vacant, 45 days vacant, 14 looks, and no units. No. 4 in early 2024.

No. 4 San Diego: 5% vacant, 43 days vacant, 10 looks, and 0.6 new per 1,000. No. 2 in early 2024.

No. 5 Central Valley: 4% vacant, 45 days vacant, 10 looks, and 3.5 new per 1,000. No. 5 in early 2024.

No. 6 Central Coast: 4% vacant, 46 days vacant, 10 looks, and 5 new per 1,000. No. 6 in early 2024.

No. 7 Sacramento: 6% vacant, 47 days vacant, 10 looks, and 1.7 new per 1,000. No. 7 in early 2024.

No. 8 North Los Angeles County/Ventura County: 5% vacant, 48 days vacant, 11 looks, and 4.5 new per 1,000. No. 8 in early 2024.

No. 9 Inland Empire: 6% vacant, 51 days vacant, 12 looks, and 4.8 new per 1,000. No. 10 in early 2024.

No. 10 San Francisco Peninsula/North Bay: 7% vacant, 44 days vacant, 7 looks, and 5.8 new per 1,000. No. 9 in early 2024.

No. 11 East Bay: 7% vacant, 48 days vacant, 9 looks, and 5.4 new per 1,000. No. 12 in early 2024.

No. 12 Western Los Angeles County: 7% vacant, 46 days vacant, 9 looks, and 5.6 new per 1,000. No. 11 in early 2024.

Bottom line

California isn’t very renter friendly. Using average scores, here’s what the typical California apartment hunter faces compared to RentCafe’s national norms …

Competitiveness score: Perhaps surprisingly, California is lower – 72.7 compared to 73.4 US.

Empty units: California has fewer vacancies – 5.3% compared to 6.7% US.

Vacancy length: California is at the national norm of 46 days.

How many looks: California’s higher – 11 compared to eight US.

Renewal rate: California switch landlords more often – 52% compared to 62% US.

New choices: California construction pace is slower – 3.4 new units per 1,000 compared to 6.1 US.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]