The Federal Reserve looks to be coming to housing’s rescue, so to speak.

Well, perhaps it’s more like the central bank is just getting a tad out of the way.

Related Articles

Mortgage rate drop could give Bay Area buyers $136,000 more in buying power than they had in August

Prop. 33: Will California voters allow cities to expand rent control?

Gov. Newsom signs housing bill package to ‘turn up the heat’ on development-averse cities

Is inflation cured? Fed’s giant rate cut turns focus to cooling job market

At long last, the Fed is slashing interest rates. Is it time to buy a home in the Bay Area?

By declaring a near victory in its battle with inflation, the Fed produced its first rate cut in four years on Sept. 18 – with promises for more in the coming months. But there are zero guarantees house hunters will race to again snap up California homes.

Consider that homebuying has run ice-cold since March 2022. That’s when the Fed launched its economic party-pooper strategy, raising the interest rates it controls.

Contemplate what that meant for the 30-year, fixed-rate mortgage. It averaged 6.9% in the past year, according to Freddie Mac. That was more than double March 2022’s low rate of 3.2%. The 30-year has averaged 5.8% since 1990.

To gauge the fallout of those costlier loans, my trusty spreadsheet looked at sales stats for existing, single-family homes tracked by the California Association of Realtors from August 2024 back to January 1990. The focus was 12-month averages in order to keep a long-term view.

One of real estate’s deepest hits came from these sky-high home financing costs. The buying pace has crashed to almost unfathomable lows.

California single-family homes were bought at an average 260,200 annual rate in the last 12 months. Let’s consider how slow that is:

It’s a trough deeper than the slowdown tied to 2008’s global financial crisis or the mid-1990s real estate mess.

Today, sales are running 40% below March 2022’s 434,100-a-year pace.

And it’s down 36% compared with the 406,500 average since 1990.

What else is at work

The sales crash isn’t just about the Fed. Another culprit is stubbornly high pricing.

Note that the state’s $856,500 median selling price over the last 12 months is up 6% from March 2022 despite the mortgage upswing.

This record high price represents a 7.1% appreciation rate in the last 12 months – and that’s somehow a cooling from March 2022’s feverish 16.6% one-year gain. Surging housing costs were one of numerous reasons why the Fed knew an overheated economy required a chill. By the way, California home prices have averaged 5.3% annual gains since 1990.

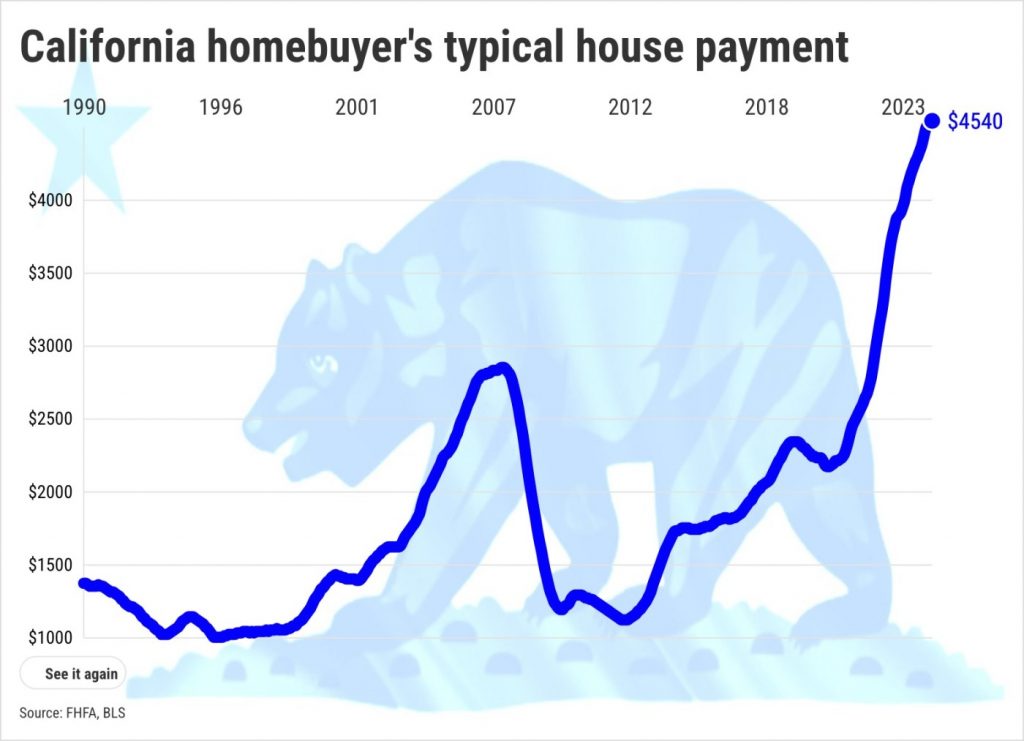

The mix of high rates and fat gains made California homebuying even more unaffordable. Ponder the estimated house payment for the median-price house at our current mortgage rate. (Did we mention having 20% down?)

In the year ended in August, the typical California buyer got a $4,540 monthly payment – 63% above March 2022’s $2,780 payment.

Oh, to get that payment, this same theoretical buyer used a $171,300 downpayment – up 6% since the Fed’s tight money campaign started.

This lack of affordability convinced most owners not to sell. So California house hunters saw paltry pickings.

The number of homes on the market equaled 2.8 months of sales in the last 12 months – nearly half this yardstick’s 5.4-month average since 1990.

Now, current supply is up 63% from March 2022’s 1.7 months – but sales remain deeply depressed. Again, think affordability.

Bottom line

The Fed says it ended its tight-money policy because the US economy is in a good spot, and the central bank wants to keep it that way.

So keep an eye on California’s job market – a critical underpinning for homebuying.

In the year ended in July, California had 1.1% annualized employment growth. Of course, that’s far off the pandemic-recovery drive that boosted annual hiring 7.6% in March 2022. But current job creation is essentially at the 1.15% average job growth going back to 1990.

Do not forget that without a job, a house hunter isn’t a homebuyer – no matter the Fed’s policy.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]