It’s Presidents’ Day, and to honor the nation’s top bosses, I figured an economic scorecard would be helpful.

Now, the commander-in-chief probably gets too much blame – or too much credit – for what’s going on in the nation’s business climate. Still, the buck stops at the Oval Office for anything in America.

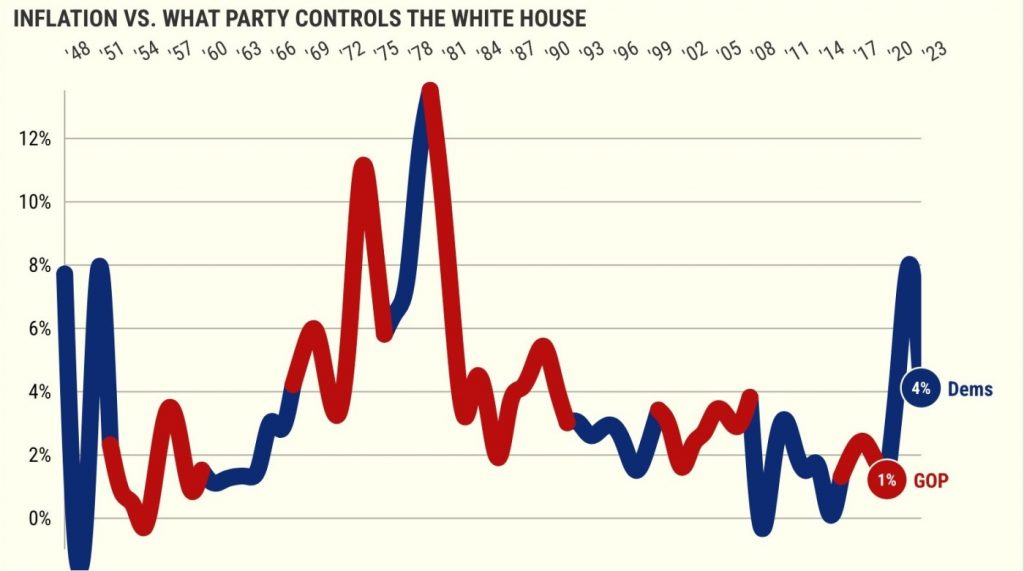

With the cost of living a hot topic, my trusty spreadsheet reviewed how presidential terms fared with the Consumer Price Index dating back to the end of World War II. Now, one challenge in gauging presidential economic influence is timing. I chose a six-month lag, so grading began with July data after the inauguration.

And because inflation is often a byproduct of a hot economy, job growth in the same period was also tracked.

So who fared worse when it came to handling the cost of living?

Carter (1977-81): 10.9%-a-year average inflation with 2.4% job growth (No. 7 of 19 terms since 1948). It’s why Jimmy Carter was a one-term president as he had few answers for geopolitical instability that drove up oil prices.

Nixon/Ford (1973-77): 8% inflation with 1.9% job growth (No. 9). Richard Nixon’s political woes forced a resignation that overshadowed serious economic ills that hurt Gerald Ford’s re-election chances.

Biden (2021-today): 6.3% inflation with 3.3% job growth (No. 3). Joe Biden’s record isn’t complete, but the cost of living is problematic. The side effect of the huge stimulus thrown at the coronavirus business chill was an overheated economy – and prices.

Nixon (1969-73): 4.9% inflation with 2.1% job growth (No. 8). Ending the Vietnam War was a boost; Middle East tensions a bust.

Reagan (1981-85): 4% inflation with 1.7% job growth (No. 12). Recession and high interest rates early in Ronald Reagan’s first term set a base for solid growth.

Johnson (1965-69): 4% inflation with 3.7% job growth (No. 1). The Vietnam War boosted the economy, prices and political tensions for Lyndon Johnson. He chose not to run for reelection.

Bush Sr. (1989-93): 3.8% inflation with 0.7% job growth (No. 15). A late-term recession led to George H.W. Bush’s re-election defeat.

Reagan (1985-89): 3.7% inflation with 2.6% job growth (No. 6). Tax cuts and pro-business laws boosted the economy in his second term.

Truman (1949-53): 3.1% inflation with 3.7% job growth (No. 2). The economic stumble from the end of World War II was reversed by the Korean War for Harry Truman.

Trump (2017-21): 2.7% inflation with 0.1% job growth (No. 18). A strong, low-inflation economy was derailed by the pandemic and that likely cost Donald Trump re-election.

Clinton (1993-97): 2.7% inflation with 2.6% job growth (No. 5). Bill Clinton’s support for free-trade policies was a short-run boon in his first term.

Bush Jr. (2001-05): 2.6% inflation with 0.5% job growth (No. 17). George W. Bush had to juggle a dot-com bust and the 9/11 attacks that chilled the business climate.

Clinton (1997-2001): 2.5% inflation with 1.7% job growth (No. 11). Middle-income tax cuts in Clinton’s second term were a plus.

Bush Jr. (2005-09): 2.3% inflation with 0.8% job declines (No. 19). A hot economy became a bubble that burst in George W. Bush’s second term.

Obama (2009-13): 2% inflation with 1.2% job growth (No. 14). Sluggishness from the Great Recession slowly wore off in Barack Obama’s first term.

Eisenhower (1957-61): 1.5% average inflation with 0.6% job growth (No. 16). Aggressive Federal Reserve throttled inflation and hiring in Dwight Eisenhower’s second term.

Kennedy/Johnson (1961-65): 1.3% average inflation with 3.1% job growth (No. 4). John Kennedy’s dream of big national projects, like a man-on-the-moon goal, juiced business output. His assassination made Johnson president.

Eisenhower (1953-57): 1.3% average inflation with 1.3% job growth (No. 13). The president focused on fiscal austerity that moderated prices and growth.

Obama (2013-17): 1.3% average inflation with 1.8% job growth (No. 10). The lethargy of the Great Recession finally wore off in his second term.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

2024 economic forecasts

Chapman: ‘Very slow growth. No recession’

CS Fullerton: ‘Cracks’ will widen to a mild recession in late 2024

US Realtors: Housing rebound from 2023’s dismal sales

California Realtors: Rising prices, sales in 2024

USC: SoCal rents to rise 2-4% a year through 2025

Related Articles

Are California pay raises keeping pace with inflation?

Elias: California’s insurance crisis pales in comparison to other states

It’s never been more expensive to be a Disney fan

Electric bill based on income? Forget it, California lawmakers of both parties agree

Fed can’t fix 27% surge in California grocery prices