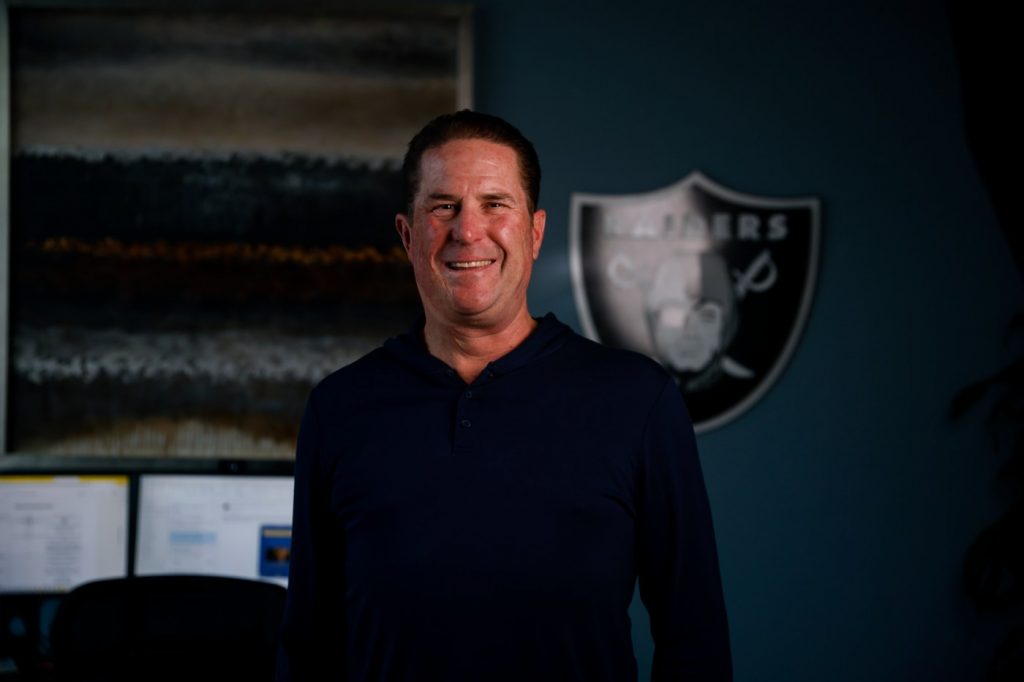

Michael Van Every, president of San Jose-based Republic Urban Properties, has leaned on his 25 years in the real estate business to guide numerous Bay Area projects from inception to completion and occupancy. He has overseen housing, office, retail, dining, mixed-use and transit-oriented development endeavors. This news organization recently talked with Van Every about California’s real estate markets.

Q: How do you assess the Bay Area office market?

A: The office market is very challenging in the Bay Area. Fewer tenants are looking to expand. The tenants that are looking for offices want to rent spaces that are smaller in size.

Q: What has caused the weakness in the Bay Area office markets?

A: Pre-COVID, the outlook was that new office space was going to be in major demand. Now, post-pandemic, the reality is we have built too much office space because there is too little demand. We now have an oversupply of office space.

Q: What’s your assessment of the Los Angeles office market?

A: Conditions are similar in Southern California. That area has an oversupply. But Southern California has more diversity in tenant mix compared with the Bay Area. The Los Angeles area has more financial companies, obviously Hollywood.

Q: Is part of the diversity in the Los Angeles office market its geographic size?

A: You have many large cities in Los Angeles County. You have Century City, Hollywood, West Hollywood, downtown Los Angeles, Burbank and Santa Monica, those are all very different office markets. No one wants to be in the Hollywood office market. Everybody wants to be in West Hollywood, Century City or Santa Monica. Los Angeles is such a big metro area.

Q: So do you see the Bay Area and the South Bay office markets as less diverse in tenants?

A: The Bay Area is very tech-dependent. Tech is now working from home 30-40% of the time.

Q: What sort of economy do you tend to see in the Bay Area when it’s so dependent on the tech industry?

A: Tech has always been boom and bust. But the long-term prospects for tech in the Bay Area are like the future. Those prospects are limitless.

Q: Does the office market in the Bay Area have to become more innovative in the post-coronavirus era?

A: We have to figure out ways for innovation to happen within the workplace and the workspace. We are still trying to understand that while dealing with three days in the office and two days at home. Property owners and facilities managers are still trying to find the sweet spot for this.

Q: What are some of the types of developments you are pursuing?

A: We’re doing some mixed-use projects.

Q: What are the main factors to make mixed-use a success?

A: If you are going to do mixed-use of any kind, whether a hotel with a restaurant, an office with ground-floor retail or a restaurant, housing with retail, it comes back to one word, location. Our headquarters is in Willow Glen in San Jose. It has Copita restaurant on the ground floor and our headquarters office on the upper floor.

Q: What can you say about your shopping center in the East Bay?

A: Republic Square in Livermore is located on El Charro Road. It has 66,000 square feet of retail but it’s located right next to two hotels that we own and next to the San Francisco Premium Outlets. This is not transit-oriented, but Interstate 580 is extremely dense in its traffic patterns. Retail follows rooftops.

Q: What is the approach for your transit-oriented Millbrae project near the BART station?

A: It’s called Gateway at Millbrae Station. This is a half-billion-dollar mixed-use project. It has 320 market-rate units and 157,000 square feet of office space that Samtrans has leased for its headquarters. The project also has an 184-room Marriott Residence Inn and ground-floor retail. We are seeing a decent progression in retail leasing, considering where we have come from since the pandemic.

Q: What are some housing developments that you are building?

A: We own the Silver and Patina apartments in Midtown San Jose in partnership with Essex Real Estate Property Trust. These are 537 units combined. Silver is 269 units and Patina is 268, with ground-floor amenities. We also have a future housing project of roughly 300 units that we have not constructed yet in partnership with Swenson.

Q: How do you assess the housing market in California?

A: One of my concerns about why housing is not being built in California rests with the state government. This is a major problem. Right, wrong, or indifferent, the optics about housing in California is the lending community believes it’s difficult to do business in California. You have CEQA (the California Environmental Quality Act), elongated timelines that bust the budgets for a housing project.

Q: Do you have worries about affordable housing?

A: The affordable housing requirements on market-rate developers are a concern. Government agencies are overburdening many projects. Governments want to see market-rate blended with affordable units. In the Bay Area, it’s impossible to make that pencil out financially.

Q: What approaches do you take to compensate for the demands of local governments?

A: We instead opt out and pay in-lieu fees. But those fees add $50,000, $75,000, $100,000 a unit. Apartments should normally cost $300,000 a unit to build without these fees. These are big increases in the cost of a housing unit.

Q: What’s your outlook for the Bay Area office market?

A: I’m always optimistic about the Bay Area. You can’t replicate the weather here. You can’t replicate the education and innovation infrastructure here. But the demand for the development of new offices will be very minimal at least for the next 10 years in the Bay Area.

Q: What about housing? Will housing construction pick up?

A: We can’t develop enough housing in the Bay Area and California to meet demand. Eventually, you will see more housing construction. But the financial industry will keep housing development from moving forward in a robust fashion as long as interest rates remain high.

Michael Van Every

Organization: Republic Urban Properties LLC

Job: President & Managing Partner

Age: 54

Birthplace: San Jose

Residence: San Jose, Willow Glen neighborhood

Education: California State University, Fresno; degree in journalism/advertising

Family: Wife, Jennifer, and son, Jacob

Five facts about Michael Van Every

— Favorite quotes: 1) “Nothing in the world can take the place of persistence.” — former president Calvin Coolidge 2) “The road to hell is paved with good intentions.” 3) “It’s only 72 hours until Monday.” — Michael Van Every

— Avid sports fan: Las Vegas Raiders, San Francisco Giants and Golden State Warriors

— Burn survivor: Injured in a household accident in 1972 with burns over 65% of his body.

— Founded the Michael Van Every Burn fund in 2023 in coordination with the Valley Health Foundation.

— Michael and Jennifer are founding investors of Copita Willow Glen, located in the building headquarters of Republic Urban Properties.