Julie Baxter just faced the most agonizing decision a person with pets can face: whether to euthanize an ailing animal in the face of the overwhelming desire to keep a beloved companion alive.

Baxter’s pain was made all the more acute as she and her partner wrestled with wanting to do all they could for their dog Roscoe, while realizing there was a limit to how much they could spend on tests and hospital stays. The 50-pound mixed breed lived with them for eight years after his rescue off the streets as a puppy.

“My partner and I had a kind of rule that $1,000 is where we’re going to stop on vet bills,” said Baxter, who lives in Broomfield, Colorado. “It was really trying to take that pragmatic approach to how much can we spend. It stinks.”

They ended up paying $2,400 for medications, tests and trips to the emergency room, but decided against further treatment that could have been as much as $8,000. Roscoe, diagnosed with pneumonia, died in early June.

Baxter wonders if she should have bought pet insurance at some point.

“I don’t know that it would have changed the outcome, but it certainly would have saved me at least part of the $2,400 in vet bills,” Baxter said. “It’s something I wish I would’ve looked into because I feel like I wouldn’t have been quite so backed into a corner.”

Rising costs of veterinary care are helping drive an increase in the number of people who are opting for pet insurance, according to the personal finance company NerdWallet. The company reported that more than 5.6 million U.S. dogs and cats were covered by pet insurance in 2023, up 17% from the year before, according to the North American Pet Health Insurance Association.

However, the number of insured animals is just a small fraction of pets nationwide. The 2023-2024 American Pet Products Association National Pet Owners Survey said there are an estimated 65 million households with dogs and nearly 47 million households with cats.

An incentive for buying insurance is increasing pet-care expenses. The cost of veterinarian services rose 7.6% from May 2023 to May 2024, according to the U.S. Bureau of Labor Statistics. A 10% jump in 2022 was the largest dating back two decades, The Associated Press reported.

Higher worker pay and higher costs for medical supplies, lab tests and pharmaceuticals are among the reasons for increases. Some veterinarians also blame the purchase of clinics and hospitals by large corporations for boosting prices.

Nearly half of the respondents to a survey by pet food and supplies online retailer Chewy said the primary reason they have wellness or insurance plans is to be able to take care of their animals if something happens to them. Katy Nelson, senior veterinarian at Chewy, said in an email that the average monthly cost for pet insurance is around $30 for cats and $50 for dogs

“Doing your own research is important. There are many options out there and sometimes selecting the right plan can feel overwhelming,” Nelson said.

A number of online sites provide comparisons of different policies, including NerdWallet and PawLicy Advisor. Pre-existing conditions typically aren’t covered. Some breeds of dogs, such as English and French bulldogs, are more expensive to cover because they are prone to certain health issues.

Cynthia Sweet, a vet at the Belcaro Animal Hospital in Denver, has insurance for her dogs. She said pet owners will marvel that things like dental care costs more for their animals than for them.

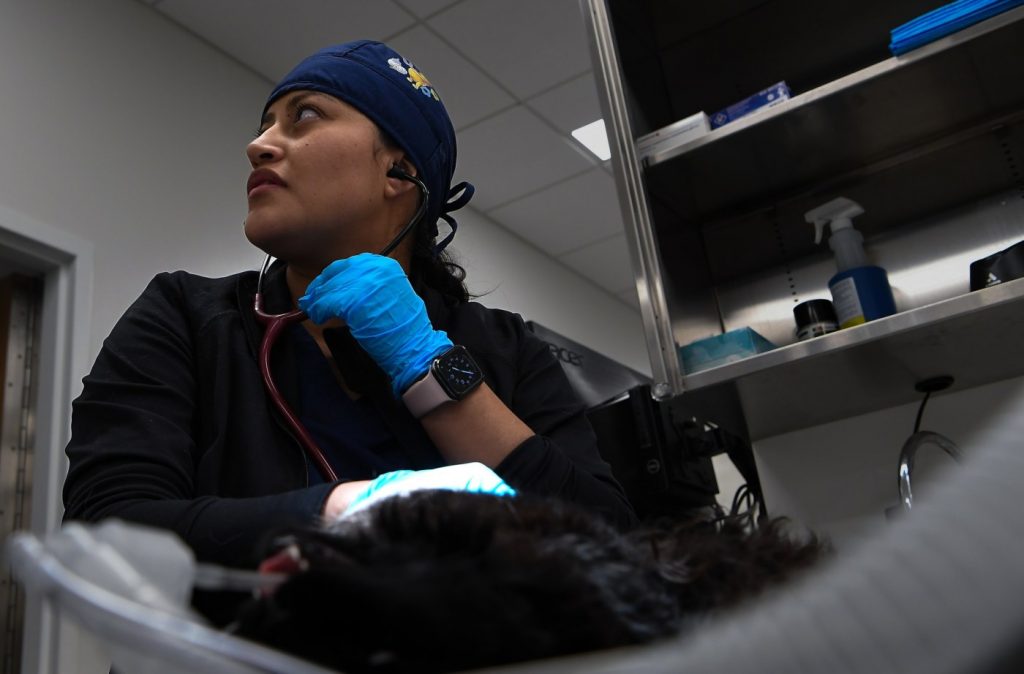

Veterinarian Dr. Cynthia Sweet, DVM, left, poses for a portrait after doing a senior wellness check on Maddie, a 14 year old boxer, right, at Belcaro Animal Hospital at 5023 Leetsdale Drive in Denver on June 18, 2024. (Photo by Helen H. Richardson/The Denver Post)

“It comes down to insurance. You don’t realize how much medical and dental and medications cost on the human side because the majority of people have insurance. That’s just not the case in the veterinary field,” Sweet said.

Bethany Hsia, a California veterinarian and co-founder of CodaPet, an in-home pet euthanasia service, said the trend of pet insurance has been on the rise in recent years. She recommended that people look at a plan’s exclusions, the premium costs, the percentage of expenses that are reimbursed and an insurer’s reviews and reputation.

Something to keep in mind, Hsia said, is that a majority of pet insurance companies don’t directly contract with vets.

“So the pet parents pay out of pocket at the time of the services to the vet and submit the itemized invoices to the insurer for reimbursement,” Hsia said. “Can I afford to buy groceries next week if I pay for this right now?”

The best time to consider pet insurance is when the animal is young and healthy, Hsia said. In any case, she suggested reviewing different options.

“It’s good to have that peace of mind where you have the ability to do something in an emergency situation and you know that those finances are going to be reimbursed,” Hsia said. “It means the world when you’re sitting there looking into the eyes of your beloved pet.”