California shoppers last year aggressively used their plastic to keep on shopping.

Golden State credit card balances at the end of 2023 were equal to $4,450 per resident, says the New York Fed. That’s the 11th-highest card usage among the states.

But to my trusty spreadsheet, it’s the jump in the balances that’s eye-catching – up 34% in two years. Equally stunning: That surge was only the 20th-biggest leap nationwide.

Related Articles

Affordable housing tower could sprout in lively San Jose district

Opinion: More debt is better than more billion-dollar climate disasters

Big Oakland hotel will shut its doors and idle more than 100 workers

Chic dining spot is eyed to replace KQED downtown San Jose space

Walgreens will close a ‘significant’ number of its 8,600 US locations

You see, Californians are not the only Americans swiping more. Credit-card users nationwide had balances of $3,950 per capita in 2023, up 29% in two years.

Credit card usage has surged as consumers spent the last of their pandemic-era stimulus funds and inflation rapidly raised the cost of daily life.

What’s most worrisome is that paying those plastic debts also became a challenge.

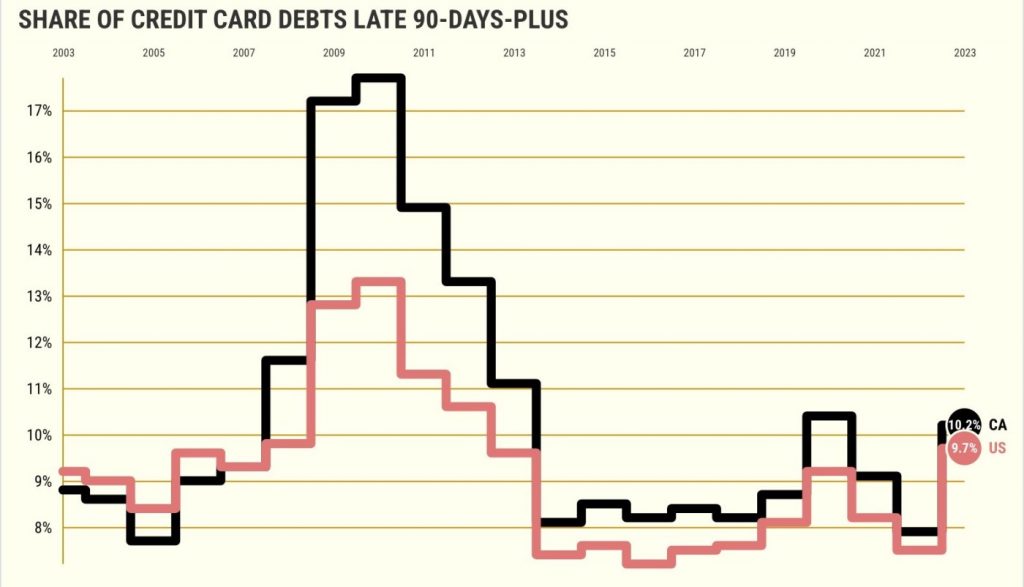

At year-end 2023, 10.23% of California credit card balances were 90-days late or worse, the 12th-highest delinquency rate in the nation. And that tardiness grew by 2.33 percentage points from 7.9% a year earlier, the No. 8 jump among the states.

Nationwide, 9.66% of card balances were delinquent last year – up 2.13 percentage points in 12 months.

By the way, the last time California’s skipped card payments were higher – before the pandemic – was 2013. Nationally, it was 2012.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]