“Swift swings” takes a quick peek at one economic trend.

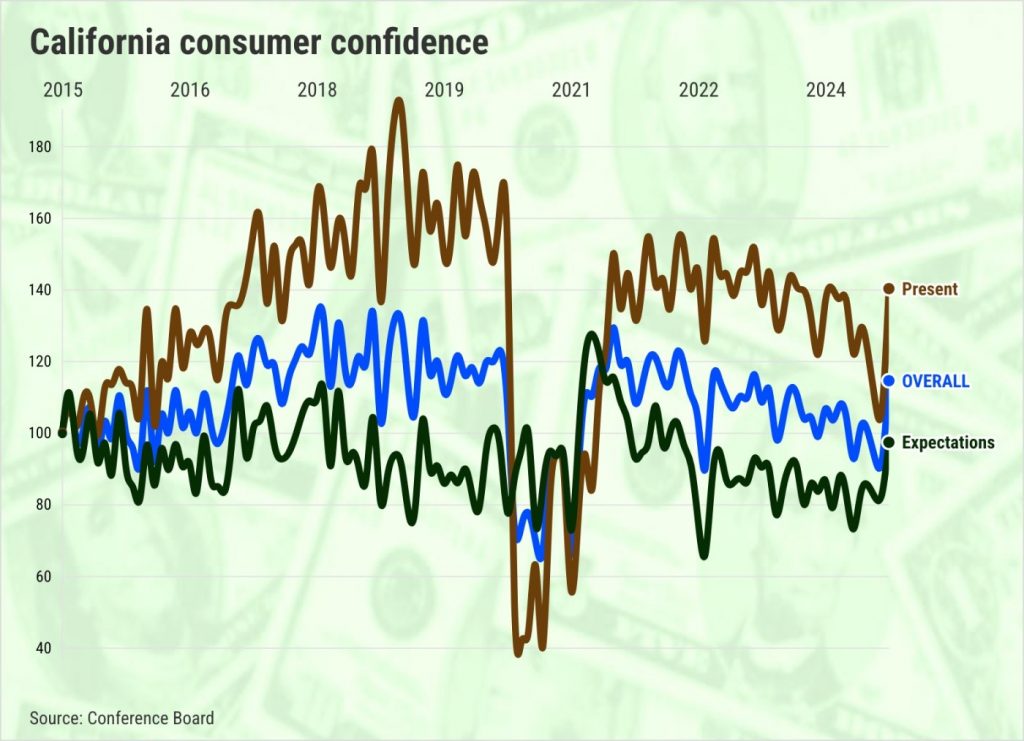

The number: California’s consumer confidence made a major U-turn in September, jumping to its highest level since February 2023 – a distinct bullishness compared to a sour national outlook.

The source: My trusty spreadsheet looked at the Conference Board’s consumer confidence index tracking shopper psyches with polling in eight states including California and nationally.

The curve

California confidence soared 25% in September, the 14th largest one-month increase in a yardstick that dates to 2007. Revised data for August ranked statewide optimism as the lowest since July 2022.

September’s surge put this index up 10% in a year. It’s also now 1% above the 2015-19 average – a reasonable measure of pre-pandemic normalcy.

Why the pop? Well, Golden Staters told the survey they feel much better about the current economy. The index’s “present situation” measurement jumped 32% in a month. the last time it was higher was 13 months ago. Still the huge gain means it’s flat during the past year and it’s off 1% vs. 2015-19.

Plus, the future looks brighter, too, by this California math.

The index’s “expectations” measurement hit a 30-month high after rising 18% higher in the month, 22% in a year, and 4% vs. 2015-19.

Details

This is definitely one of those California things.

Nationally, confidence was off 7% in September – the biggest one-month dip in three years. That left the index down 5% in a year, and 14% below 2015-19.

And the seven other states tracked? No September gains can be found. Look at the by the month’s dips – worst to least …

Pennsylvania: 18% lower in the month, off 13% in a year, and down 34% vs. 2015-19.

New York: 14% lower in month, off 11% in year, down 2% vs. 2015-19.

Michigan: 10% lower in month, off 12% in year, down 15% vs. 2015-19.

Florida: 8% lower in month, off 12% in year, down 20% vs. 2015-19.

REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

Texas: 5% lower in month, up 15% in year, down 14% vs. 2015-19.

Ohio: 5% lower in month, off 8% in year, down 5% vs. 2015-19.

Illinois: 4% lower in month, off 11% in year, up 2% vs. 2015-19.

The spin

How so? Perhaps it’s California’s job market, which is outpacing the nation and making locals feel better about their finances.

And the Golden Sate’s lofty home prices makes interest rates a big monetary factor. Did hopes for much cheaper mortgages make a difference?

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Related Articles

Is inflation cured? Fed’s giant rate cut turns focus to cooling job market

California bankruptcies jump 25% in a year to 4-year high

California consumer confidence plummets to 4-year low

California shoppers get nervous as confidence tumbles to 2-year low

How long will California remain world’s 5th-largest economy?